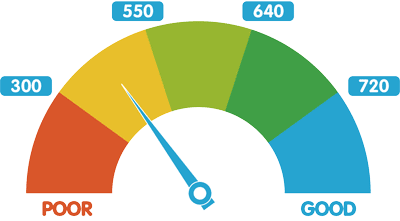

Credit Cards for Poor Credit

Are you worried that you can't improve your financial situation due to poor credit? Well, you don't need to, just because you currently have poor credit doesn't mean that you won't qualify for a credit card. All you need to do is let us help you get creative, and find a card that will help to boost your credit score. We have an extensive list of credit card issuers that will offer you credit even if you have poor credit. The reason for this is that they know that they are providing a financial tool to help customers as you get back on the right track. So, if you have poor credit, and want to improve your overall rating and finances, check out some fantastic deals listed below.